According to the "Global EV Outlook 2021" issued by the International Energy Agency (IEA), the number of electric vehicles (including hybrid electric vehicles but excluding motorcycles) reached 10 million worldwide in 2020, a 40% increase for a second consecutive year, and accounting for 1% of all four-wheel drive vehicles. The number of electric vans, buses, and heavy trucks worldwide reached 400,000, 600,000, and 31,000 respectively.

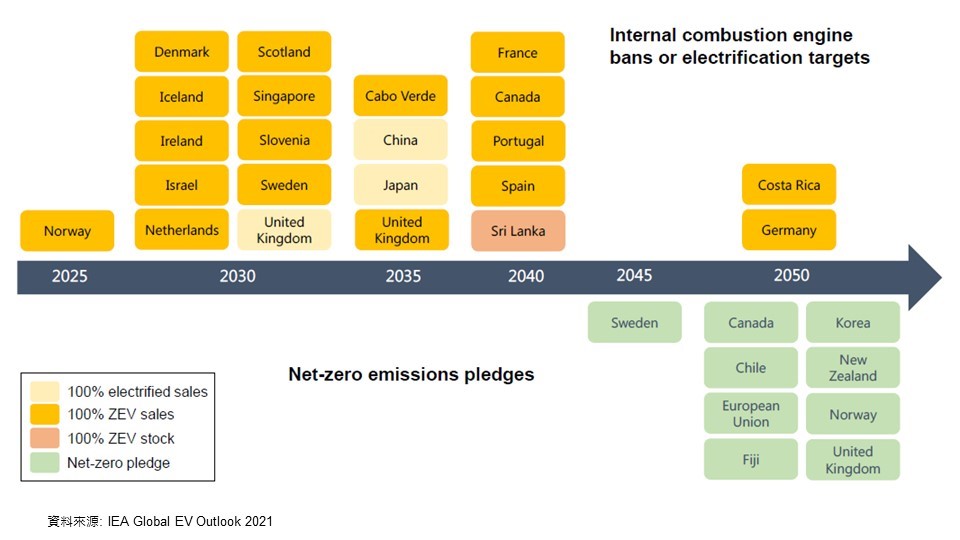

Despite the COVID-19 pandemic, approximately 3 million electric vehicles were sold globally last year, a YoY increase of 41%. The number accounted for 4.6% of new cars sold in 2020 compared with 3% in 2019. Electric cars in No. 1 Norway reached a record high sales share of 75%. One of the reasons may be the government incentives rolled out in Europe and China, where the ban on the sale of fuel vehicles has accelerated the introduction of new models by automakers; in addition, the continued decline in battery costs is another reason.

For the first time, Europe overtook China as the biggest EV market last year

2020 is the target year for EU CO2 emission standards, which limit the average carbon emissions per kilometer of new vehicles to 95 grams and below. As the governments in Europe strongly advocated manufacturing low-carbon electric vehicles and rolled out more and more subsidy schemes, the number of EVs sold in Europe ballooned to a new high of 2.1 million in 2020.

Apart from the sales volume, major automakers successively rolled out new electric vehicle models in 2020, which totaled 370 worldwide, a 40% increase from 2019. The driving range of electric vehicles started to plateau. In 2020, the weighted average range for a new battery electric vehicle (BEV) was about 350 kilometers, up from 200 kilometers in 2015. The average driving range of a plug-in hybrid electric vehicle (PHEV) remained relatively constant at about 50 kilometers.

Automakers were committed to increasing EV sales volume

Last year, notably 18 of the 20 largest automakers announced intentions to increase the number of available models and boost production of electric light-duty vehicles (LDVs). Some automakers plan to reconfigure their product lines to produce only electric vehicles; Ford will focus on electric car sales in Europe from 2026 and only sell electric cars from 2030; Volvo will only sell electric cars from 2030; General Motors plans to offer only electric LDVs by 2035.

The announcements by these automakers translate to the estimated cumulative sales of electric LDVs of 55-72 million by 2025. In the short run (2021~2022), the estimated cumulative sales volume is quite consistent with the projection of electric LDVs in the IEA's stated policies scenario. By 2025, the estimated cumulative sales volume is aligned with the trajectory of the IEA's sustainable development scenario.

Battery production lagged behind EV sales; Europe saw the highest rise in demand

Demand for supporting measures has risen with an increase in EV sales. First, let's take a look at the battery. Th automotive lithium-ion battery production was 160 gigawatt-hours (GWh) in 2020, up one-third from 2019. In Europe, demand for batteries last year exceeded the domestic production capacity. Battery production continued to be dominated by China, accounting for over 70% of the global battery production capacity. Lithium-iron-phosphate batteries regained sales share but remained under 4% in the EV market.

Mass production means the continued decline in battery costs. According to the BNEF’s yearly survey of

battery prices, the weighted average cost of automotive batteries in 2020 dropped by 13% from 2019,

reaching US$137/kWh.

As to chargers, publicly accessible chargers, including slow and fast chargers, reached 1.3 million units

worldwide in 2020. The installation of publicly accessible chargers has increased sevenfold in the last

five years. Due to the COVID-19 pandemic, most European countries failed to meet the recommended

electric vehicle supply equipment (EVSE) target in 2020. Member states were recommended to aim for

1 public charger per 10 EVs, a ratio of 0.1 in 2020.